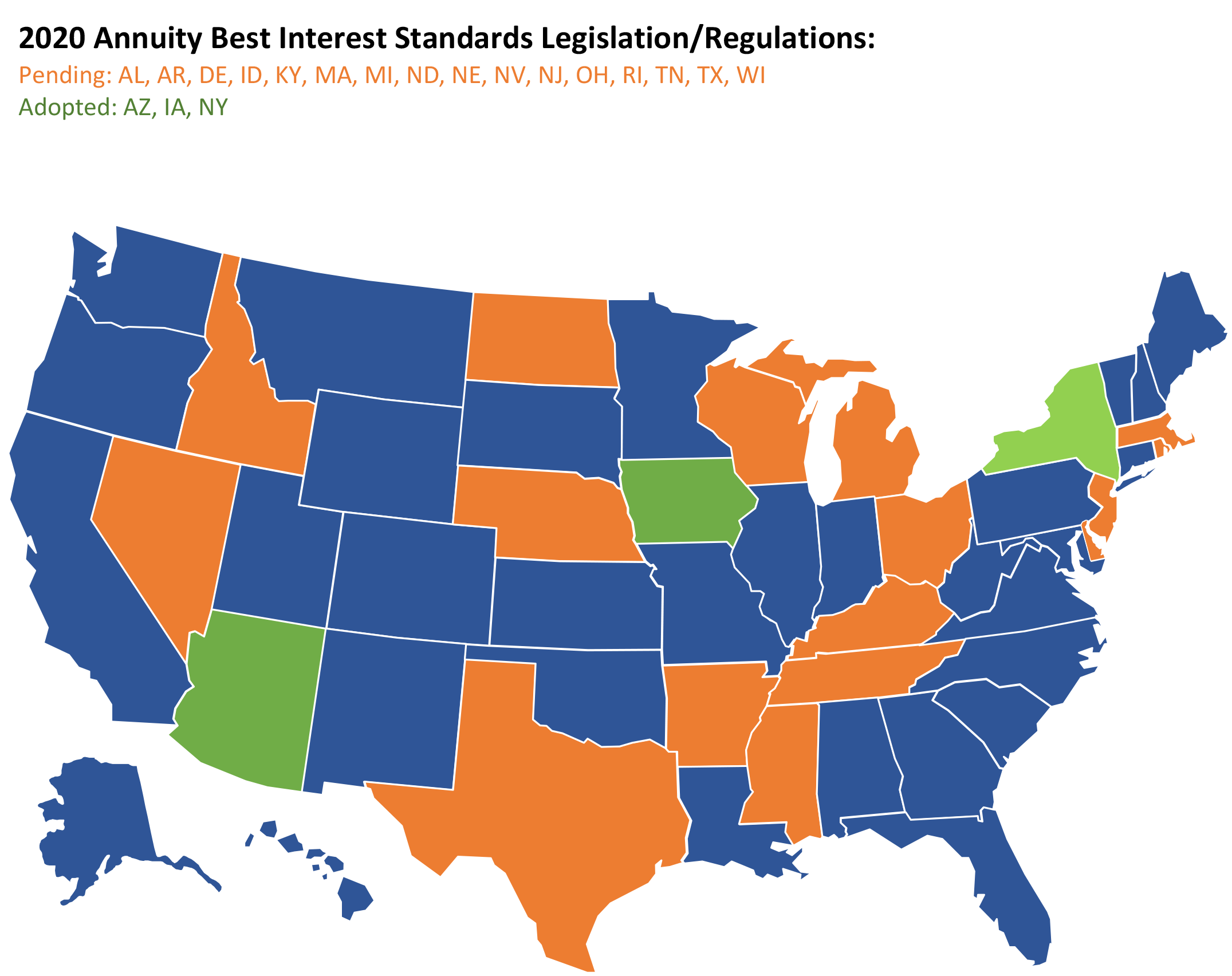

New York is one of three states to have implemented annuity transactions rules for producers that create a best interest standard in line with the National Association of Insurance Commissioners’ (NAIC) Suitability in Annuity Transactions Model Regulation. NAIFA is urging other states to adopt the NAIC model, which would enhance consumer protections while ensuring agents and advisors are able to effectively continue serving consumers in New York.

In early 2020 after nearly two years of extensive discussion and debate the NAIC adopted amendments to the NAIC Suitability in Annuity Transactions Model Regulation, which regulates producer and insurer recommendations for all annuities (NAIC model laws and regulations often serve as the basis for state insurance laws and regulations). The amendments consist of enhanced consumer protections and other revisions, and the revised NAIC Model requires producers and insurers to act in the best interest of annuity purchasers and to not put their own financial interests ahead of the consumers’ interest. The amended Model, which aligns well with the SEC’s Regulation Best Interest, will raise the standard of care required of financial professionals while preserving consumers’ access to valuable financial advice, services and products.

NAIFA was an active participant in the development of these revisions and supports the amended Model regulation. As stated above, the adoption by the states of these amendments is a top advocacy priority for NAIFA, and our state chapters should encourage their state insurance regulators to seek the adoption of these NAIC amendments.